Timothy Inklebarger is a journalist living in Chicago who has more than 20 years of experience as a writer and editor for The Associated Press, Chicago Journal, Crain Communications, and Chicago Agent Magazine, among others.

Timothy Inklebarger is a journalist living in Chicago who has more than 20 years of experience as a writer and editor for The Associated Press, Chicago Journal, Crain Communications, and Chicago Agent Magazine, among others.

We’re barely a quarter of the way through 2024, and tech innovations in the supermarket industry continue to surface on a daily basis.

At this point, not a single section of the store is untouched by new technology in some way — even the parking lots of many major retailers are equipped with AI-powered video surveillance.

Retail media networks, robot warehouse workers, cashierless checkout and the proliferation of AI-powered shopping carts that allow customers to bypass the checkout lane entirely are just a fraction of the cutting-edge tech making its way into stores across the nation.

We’ve been tracking these advances in tech at trade shows, in webinars and through good old-fashioned shoe-leather reporting to bring the industry the most comprehensive and up-to-date information available. Here’s what we’ve learned so far.

Amazon still experimenting

Amazon’s grocery game is still in its infancy relative to longstanding competitors like Walmart, Kroger, and others, but the retail giant has some of the most advanced technology in the industry — and it’s just getting started.

Amazon might be one of the new kids on the block but it’s clearly a force to be reckoned with and has the muscle to experiment in ways that keep its competitors up at night.

The online retailer and nascent grocer owns more than 500 Whole Foods Market stores and most recently made tech news with the rollout of its AI-powered smart carts at a location in San Mateo, Calif. It’s the sixth Whole Foods supermarket where the so-called Dash Carts have been deployed.

The carts allow customers to log in to their Amazon or Whole Foods accounts, place items in the basket — it even has a scale for produce — and then walk out of the store. The bill is charged directly to the customer’s account.

The expansion of the smart-cart program made headlines about one month after Amazon released its AI-powered shopping assistant Rufus.

“Rufus is an expert shopping assistant trained on Amazon’s product catalog and information from across the web to answer customer questions on shopping needs, products, and comparisons, make recommendations based on this context, and facilitate product discovery,” Amazon said in its fourth quarter earnings report.

The new assistant was made available to a small set of shoppers but the company plans to make Rufus available to all its U.S. customers in the weeks ahead.

This comes almost exactly a year after Instacart announced plans to release “Ask Instacart” which combines ChatGPT, AI developed by Instacart, and an extensive list of product data. The feature allows shoppers to ask questions about recipes, meal plans, and other subjects.

Smart carts on a roll

Speaking of AI-powered shopping carts, it’s looking like 2024 could be the year of the smart cart. Not only is Amazon getting buzz for its smart-cart program, Instacart has been rapidly scaling its own, and giving Amazon a run for its money.

Amazon has rolled out its AI-powered Dash Carts at six Whole Foods locations, the most recent in San Mateo, Calif.

The San Francisco-based grocery delivery and tech company has deals with grocers all over the country to begin using its Caper Carts this year. That means thousands of the smart carts — which work similarly to Amazon’s carts, using AI and computer vision to tally purchases the moment they’re placed in the cart — will begin appearing at supermarkets such as Fairway Market, Geissler’s, ShopRite, and Sobeys.

Instacart is taking the tech a step further with retail media opportunities available right on the carts. The digital ads on its smart shopping carts have been piloted at Good Food Holdings’ Bristol Farms supermarkets in Southern California since the beginning of the year.

The ads initially consisted of Instacart’s CPG partners Del Monte Foods, Dreyer’s Grand Ice Cream, and General Mills, but those are expected to grow as is the number of stores where the digital ads are available.

Enormous tech companies aren’t the only game in town when it comes to smart-cart technology. The National Retail Federation Big Show convention in January featured a number of AI-powered shopping cart companies.

Among them was Easy Shopper, a Munich, Germany-based company that builds smart-cart tech that can be retrofitted to existing carts. As of January, the company has already deployed carts at more than 180 stores throughout Germany and has its sights set on U.S. grocers.

Autonomous stores gain traction

Computer vision technology is transcending futuristic shopping carts and heading into the store itself in some locations. Amazon has already tried leaning into the tech with its Just Walk Out technology through its Amazon Go convenience stores, but the retail juggernaut has had trouble scaling the concept.

Amazon CEO Andy Jassy called for a pause on expansion of the Amazon Go stores in early 2023, but after a few months’ hiatus, the company opened a new location in metro Seattle in September. But over seven years after the opening of the first Amazon Go in Seattle, an estimated 22 stores are currently in operation, according to ScrapeHero.com.

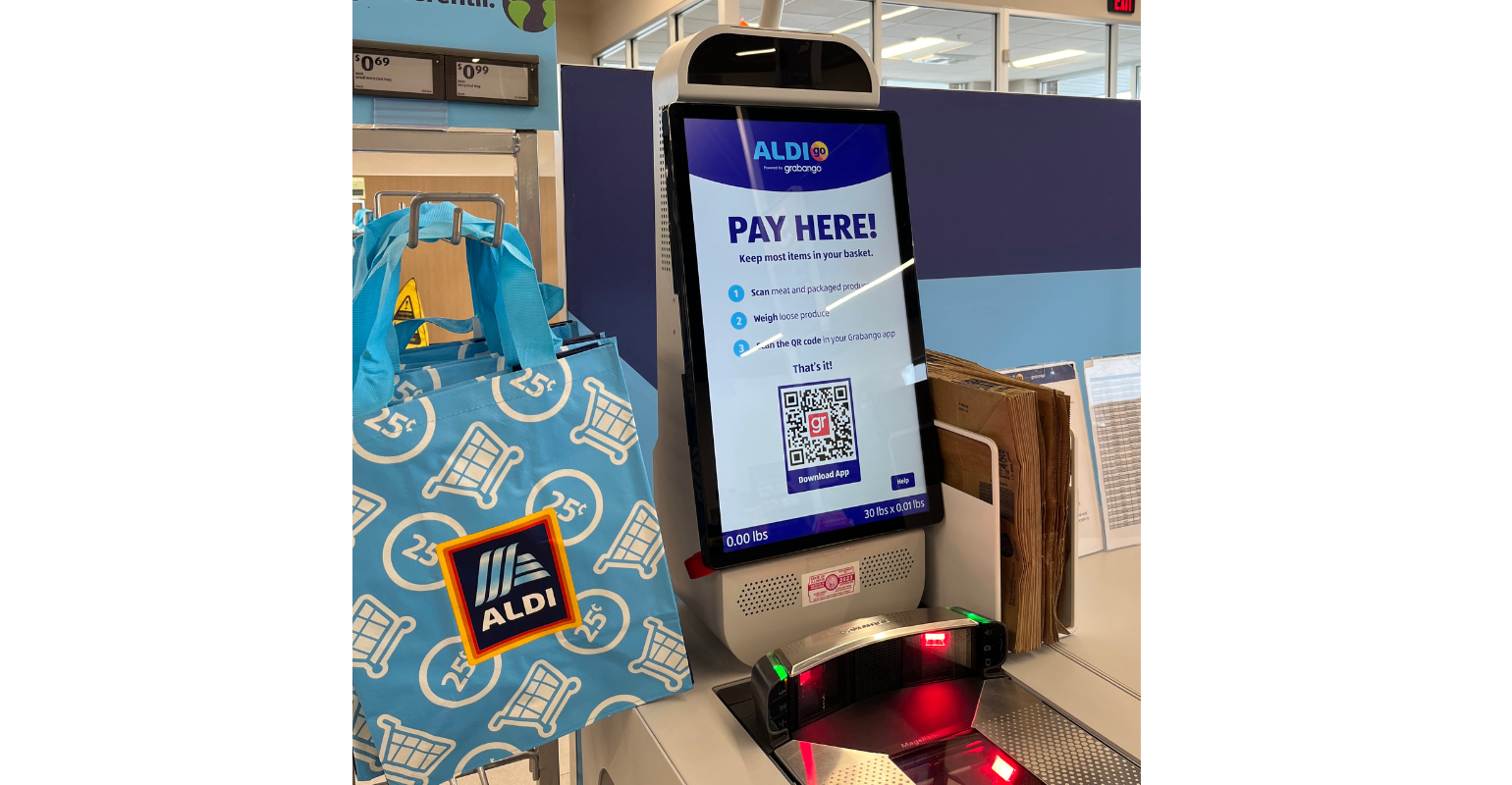

Meanwhile, numerous other companies, both large and small, are entering the autonomous grocery market. German discount grocer Aldi has been testing technology by Berkeley, Calif.-based checkout-free tech company Grabango at one of its stores in Aurora, Ill. — a new concept it’s branding as “Aldi Go.”

Grabango installs cameras throughout the store that can accurately identify when a customer places an item in the basket.

A visit to the store in early February revealed that downloading the app and adding a credit card only takes about five minutes. Shoppers scan a QR code at a kiosk at the front of the store once they’re finished shopping, and their credit or debit card is charged without scanning items individually. Aldi has been testing technology by Berkeley, Calif.-based checkout-free tech company Grabango at one of its stores in Aurora, Ill. — a new concept it’s branding as “Aldi Go.”

Aldi hasn’t spoken publicly about the pilot project yet, but if the discount grocer’s rapid expansion across the U.S. is any kind of indicator, this technology has the potential to scale quickly.

The computer-vision technology may still seem like something out of a science fiction movie for most shoppers, but some smaller players are proving that it’s not out of reach for mom-and-pop businesses like Nourish + Bloom in Fayetteville, Ga. The autonomous grocer has been operating since January 2022.

More computer vision

Smart shopping carts and automated stores are just a few of the ways computer vision is revolutionizing the modern grocery store.

Sam’s Club deployed its own technology to allow customers to bypass the checkout line as early as 2019 called Scan & Go, which gives shoppers the option of scanning products with their smartphones. That tech still requires an employee to check the receipts to make sure they pair up with the items in the basket.

In January, Sam’s Club began testing computer vision technology that checks the receipts against the basket. The company said it aims to install the new technology in as many as 600 clubs by the end of the year.

Sam’s Club is now testing computer vision technology that checks the receipts against the basket. They plan to install the new technology in as many as 600 clubs this year.

Computer vision is not only in play for customers inside the brick-and-mortar location — at many larger retail locations, AI is watching before shoppers even enter the store. At NRF’s Big Show convention, Supermarket News caught up with Rhod Thomas, chief customer and commercial officer with license-plate recognition tech company Auror.

Auror works with some of the biggest retailers like Walmart, ensuring that customers with a history of problematic behavior are identified as early as possible. “We then run those plates against a database of known offenders, and then we’ll send alerts to your store team or your operations center, so you know in real time that that offending vehicle is back at your store,” Thomas said in an interview in January.

Computer vision is also making its way into the self-checkout aisle through new technology by checkout terminal manufacturer Diebold Nixdorf, which released a new self-checkout register that can tell if a shopper deliberately fails to scan an item, uses false barcodes, or scans only one of several items.

The high-tech checkouts can also estimate the age of the shopper for liquor purchases, allowing those determined to be over the age of 27 to purchase alcohol without having an employee verify their ID.

Omnichannel still growing

Competition in the online grocery business intensified in 2023, even while online grocery sales dipped 1.2% year over year to $95.8 billion, according to the annual results of the Brick Meets Click/Mercatus Grocery Shopper Survey released in January.

Mass merchandisers and hard discount grocers gained market share in 2023, ending the year up 460 basis points to 45%, at the expense of supermarkets, which were down 390 basis points to 29%.

“These annual results show that 2023 was very challenging for grocery retailing as higher prices chipped away at household purchasing power even though inflation has slowed considerably since its peak in 2022,” said David Bishop, partner at Brick Meets Click, in January. “Despite the challenges, pickup continues to prove its appeal to shoppers, even without the benefits of expanded availability and/or aggressive promotions that aided delivery in 2023.”

Slumping post-pandemic online sales aren’t deterring Instacart, though, which is expected to make some strategic bets on technology over the next year. Instacart CEO Fidji Simo said at the company’s Q4 earnings call in mid-February that Instacart was cutting 250 positions in order to streamline operations and focus on tech projects.

“All of these new initiatives that hold a lot of promise are things that we want to be able to fund fully, and that means reshaping the organization and streamlining in certain areas,” she said.

Meanwhile, DoorDash is keeping the pressure on, with CEO Tony Xu noting in the company’s Q4 earnings call in mid-February that the grocery delivery side of its business is growing and one in five of its customers have used its non-restaurant category.

Groceries from above

It might be the year of the smart cart, but drone delivery is quietly making inroads one small delivery at a time. We spoke with Shannon Nash, chief financial officer of Google-owned drone delivery company Wing, late last year about the company’s expansion in Texas.

Wing partnered with Walmart last year, building a drone delivery program out of two Walmart Supercenter locations in metro Dallas.

Wing partnered with Walmart last year, building a drone delivery program out of two Walmart Supercenter locations in metro Dallas. The launch of the Wing program at the first Supercenter location opened the service to 60,000 households in the area, according to Nash. They can currently carry almost three pounds of goods and travel at 65 miles per hour.

Walmart expanded its drone delivery service in January, announcing it would use Wing and another drone delivery company, Zipline, to provide delivery to 75% of the population in Dallas-Fort Worth.

Operational since 2016, Zipline is active on four continents and has completed millions of deliveries.

“Our first few months delivering to Walmart customers have made it clear: Demand for drone delivery is real,” said Wing CEO Adam Woodworth in January. “The response has been incredible from customers ordering drone delivery from Walmart every day, and it’s a testament to our partnership that we’re now expanding our footprint to bring this innovative delivery option to millions of Texans. If this milestone is any indication, we believe 2024 is the year of drone delivery.”